The Campfire

Everything you need to know about driving in the UK, and getting insured

UK immigration rules simply explained

Discover who UK immigration rules apply to, how they affect daily life, and what to know if you plan to stay long term.

Becoming a UK Citizen

A guide to becoming a UK citizen, including permanent residency, the Life in the UK test, and what the process involves.

Settled Status and Indefinite Leave to Remain

Learn the difference between Settled Status and Indefinite Leave to Remain in the UK, who can apply, and what each status allows you to do.

How to register with a GP in the UK

See if you’re eligible to register with a GP in the UK, whether you need an NHS number, and what to expect after signing up.

What invalidates car insurance?

Learn what invalidates car insurance in the UK, including common mistakes, changes you must report, and how to avoid having a claim refused.

Does car insurance cover repairs?

Does car insurance cover repairs? Learn which types of car insurance pay for repairs, what’s excluded, and when claims are approved.

What is classic car insurance?

What is classic car insurance and how does it work? Learn how specialist cover differs from standard car insurance, including agreed value and mileage limits.

Car insurance and weather warnings: what’s covered in the UK

Is car insurance valid during weather warnings? Learn how UK insurance works in red alerts, storms, flooding, and bad driving conditions.

What is a named driver on car insurance?

Learn what a named driver is, how it differs from the main driver, how it affects price and no claims discount, and when to add someone to your policy.

Car insurance when someone dies: what happens next?

What happens to car insurance when someone dies? Learn the steps to take in the UK, whether cover is still valid, refunds, and how to handle the policy.

Car insurance and credit scores

Does your credit score affect car insurance in the UK? Learn how credit checks work, what matters most, and how to get insured if you’re new to the UK.

What is personal accident cover in car insurance?

What does personal accident cover mean in car insurance? Learn what it covers, who it applies to, and how payouts work in the UK.

VAT and car insurance

Is there VAT on car insurance in the UK? Learn how car insurance is taxed, why VAT does not apply, and how Insurance Premium Tax works.

Car insurance groups – how to check

Learn how UK car insurance groups work, which are the cheapest car insurance groups and how to check which group your car is in.

Guide to driving in the UK on an international licence

Driving in the UK with a Foreign Licence? Discover how to drive in the UK with your international licence and explore important regulations.

What Is A No Claims Discount and How Does It Work?

Confused about your No Claims Discount? Discover how to get rewarded for your claim-free driving experience with Marshmallow.

How to provide No Claims Discount proof

A step-by-step guide to proving your claims-free driving history. We don’t mind what country it’s from – find the documents we accept and upload it on the app.

How to get cheap car insurance in the UK: 11 ways to save money

Looking for cheap car insurance in the UK? Discover 11 proven ways to make your car insurance cheaper, from choosing the right car to building your no claims discount.

Mobile Phone Driving Laws in the UK: What You Need to Know

Everything about UK mobile phone driving laws: penalties, exceptions, using phones in cradles, and what counts as illegal. Stay safe and avoid fines.

UK Road Signs and What They Mean: A Complete Guide

Learn what UK road signs mean with our complete guide. Discover how many road signs are in the UK, what each sign means, and get resources to pass your theory test.

What is a rental guarantor? A complete guide

Need a rental guarantor in the UK? Learn what being a guarantor means, who can be one, how to stop being a guarantor, and alternatives for UK newcomers.

How does car insurance work in the UK? A simple guide

New to UK car insurance? Learn how car insurance works in the UK, the types of car insurance available, and what you need to know before getting cover.

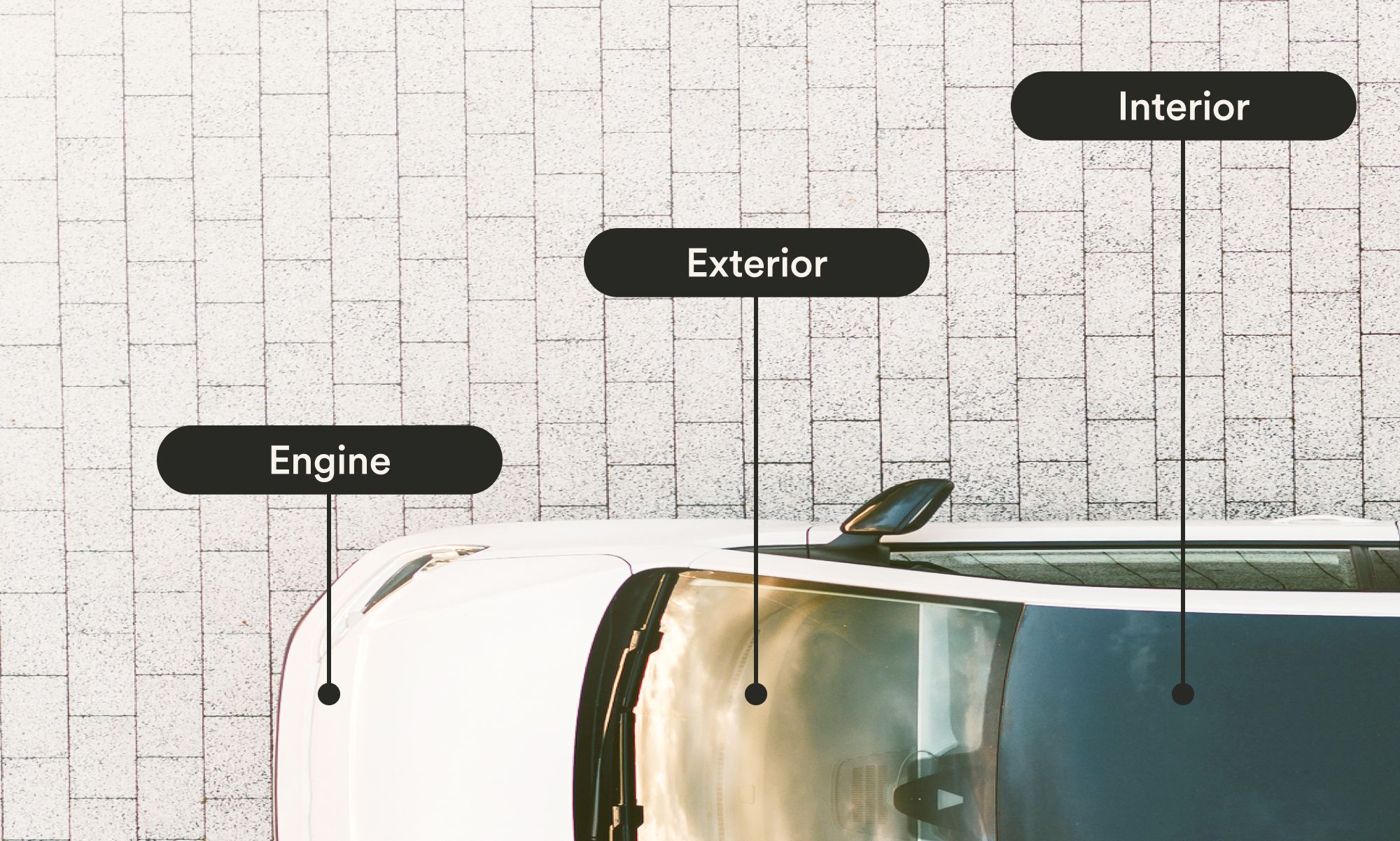

Used car checklist: 5 things to look for

Thinking of buying a second-hand car? We asked ClickMechanic, the UK's leading car maintenance platform, for the top things you should check your car for.

3-step plan for getting onto the housing ladder

Moved to the UK and planning on how to buy a house? Learn how to build your credit score and get onto the housing ladder with this simple guide.

What is car insurance excess?

Want to know what an excess actually is and how it affects the price of your car insurance? Read this blog...

The 7 UK driving etiquette rules you need to know

From the polite to the puzzling – some things UK drivers do don’t seem to make sense. Find out what it all means with these seven unwritten road rules explained.

What is Third Party Car Insurance? A Simple Guide

What is third-party car insurance and what does it cover? Learn what third-party only insurance means, if it's cheaper and how it compares to fully comprehensive insurance.